De.Fi: The Best Alternative to Zapper

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

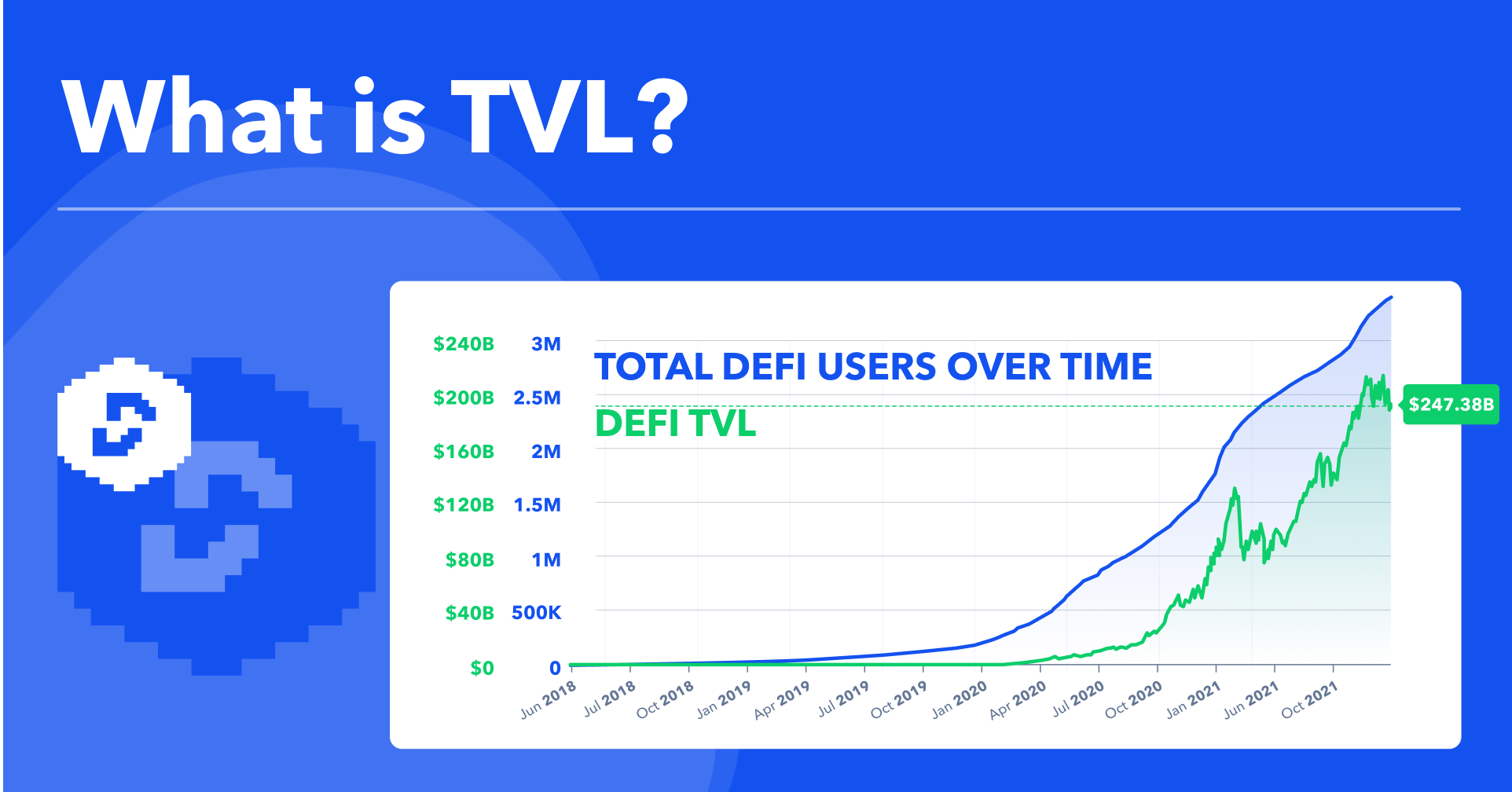

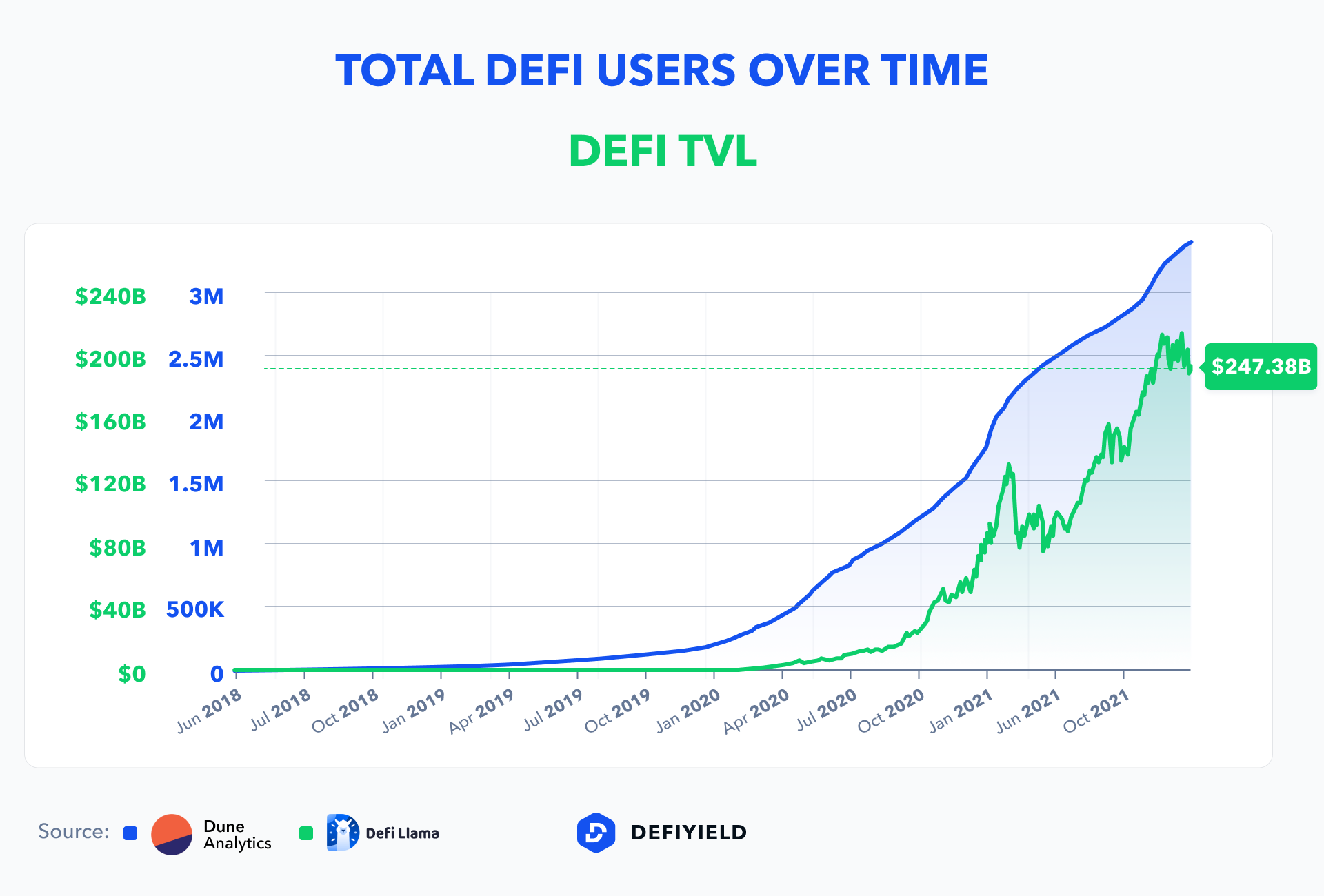

The TVL of Decentralized Finance or “DeFi” shows how much dollar value of crypto assets are locked in DeFi marketplaces.

Read the detailed explanation below!

What is DeFi TVL meaning?

What is the TVL of the DeFi project?

TVL of some key DeFi projects

Where to get the DeFi TVL data?

DeFi Pulse

DeFi Llama

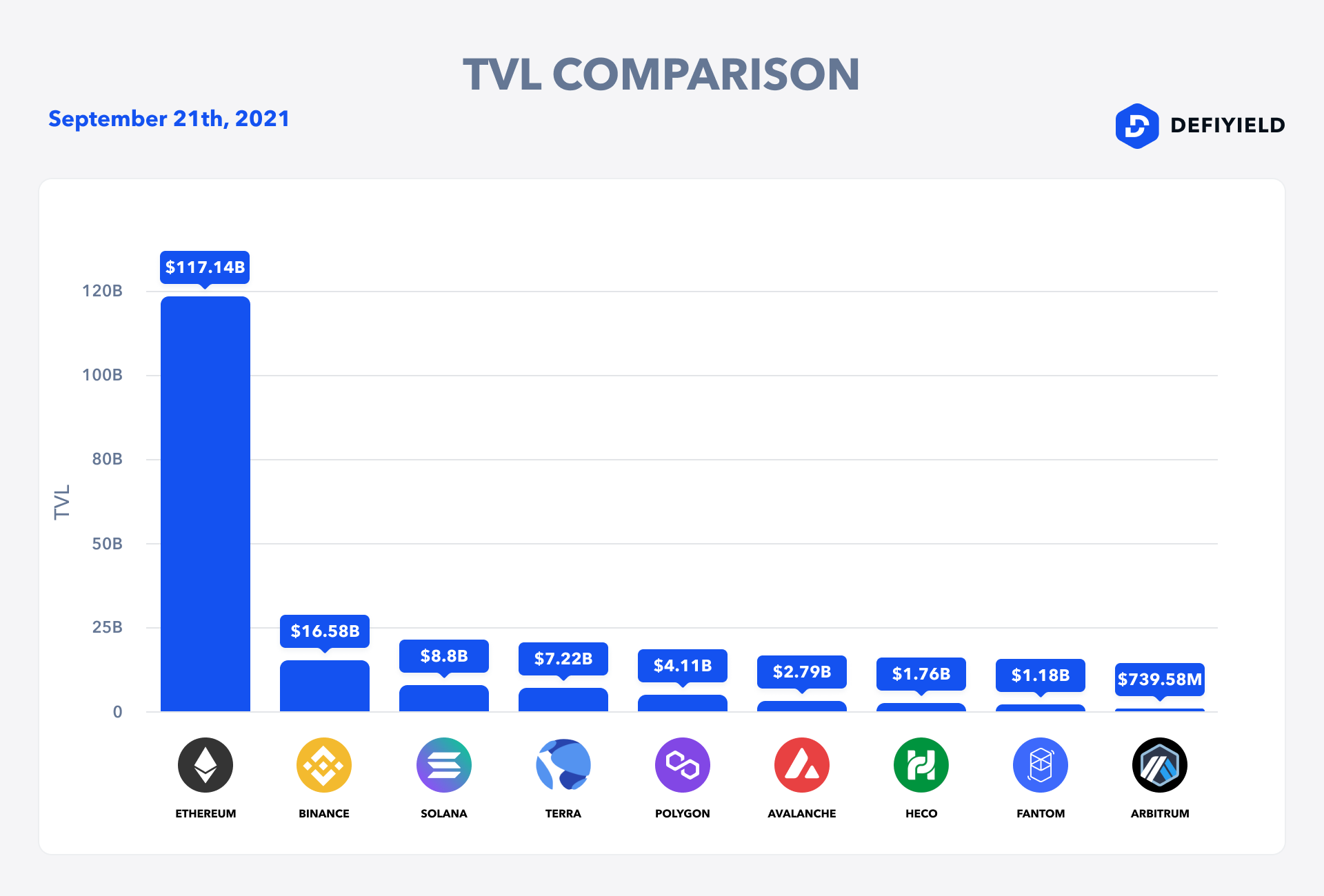

TVL by DeFi chains

Ethereum TVL

Binance TVL

Solana TVL

TVL vs Market Cap

But Wait- What is Double Dipping?

The TVL term means the total value in $US Dollar of all assets deposited into the project’s smart contracts. TVL is commonly calculated in US dollars but could be converted to other currency.

Although not perfect, the metric is used to measure the overall ‘health’ of the DeFi and cryptocurrency markets.

Watch a quick walkthrough!

Usually, you can find the TVL for a specific project by visiting its website.

You can track TVL on such websites like DeFi Pulse. Total Value Locked as a standard was set by DeFi Pulse.

However, note that DeFi Pulse does not include most funds locked into DeFi yield farming products because DeFi Pulse monitors each protocol’s underlying smart contracts on the Ethereum blockchain only.

Every hour, the charts are refreshed by pulling the total balance of Ether (ETH) and ERC-20 tokens held by these smart contracts. TVL(USD) is calculated by taking these balances and multiplying them by their price in USD. The open-source project adapters that power DeFi Pulse metrics are here.

DeFi Llama calculates the TVL by almost all of the DeFi chains, rather than sometimes which is only calculated on Ethereum.

You can check the TVL amount of the separate chains. Naturally, the more value is locked, the more yield farming may be going on. Because money moves to the where it earns the highest yield.

The difference in calculations of DeFi Pulse and DeFi Llama (as with any other data aggregators) stem from the different data providers and different rules of the projects including.

On the macro level, TVL can be considered as the total cost of all assets deposited and held on the Ethereum blockchain smart contracts (or any other blockchain).

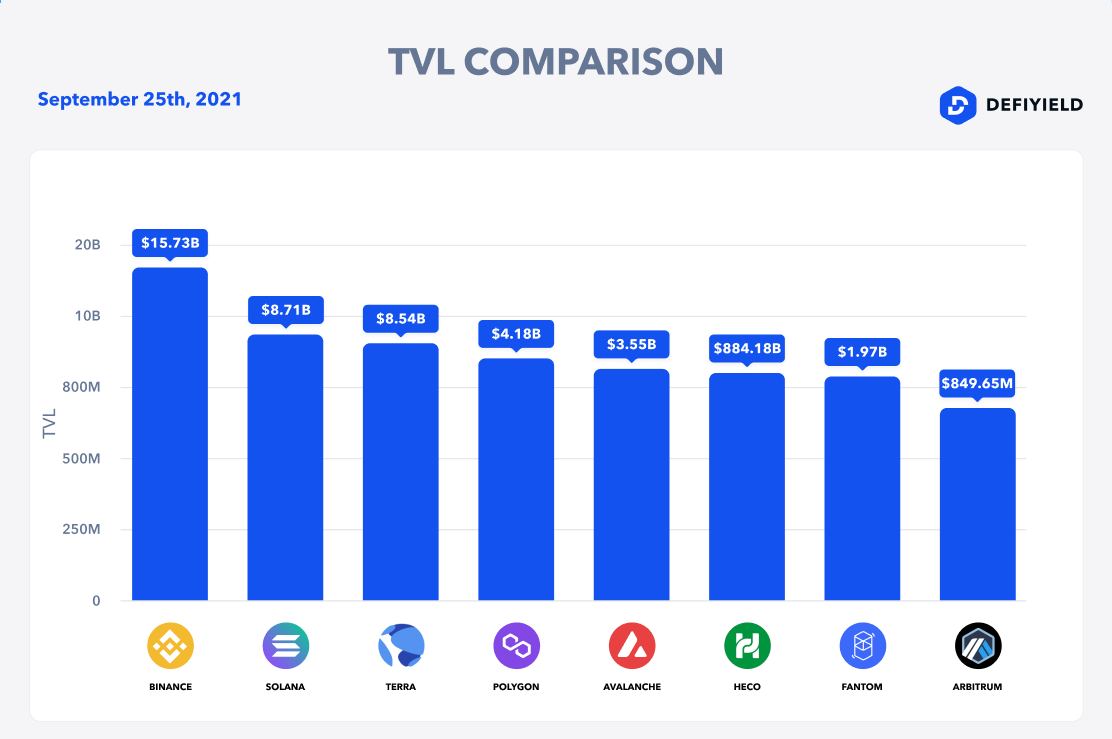

To compare the TVL of different chains you can go to DeFi Llama — it is aggregating TVL by almost all of the blockchains.

Below you can find the TVL of 5 main chains sorted by the largest->smallest TVL.

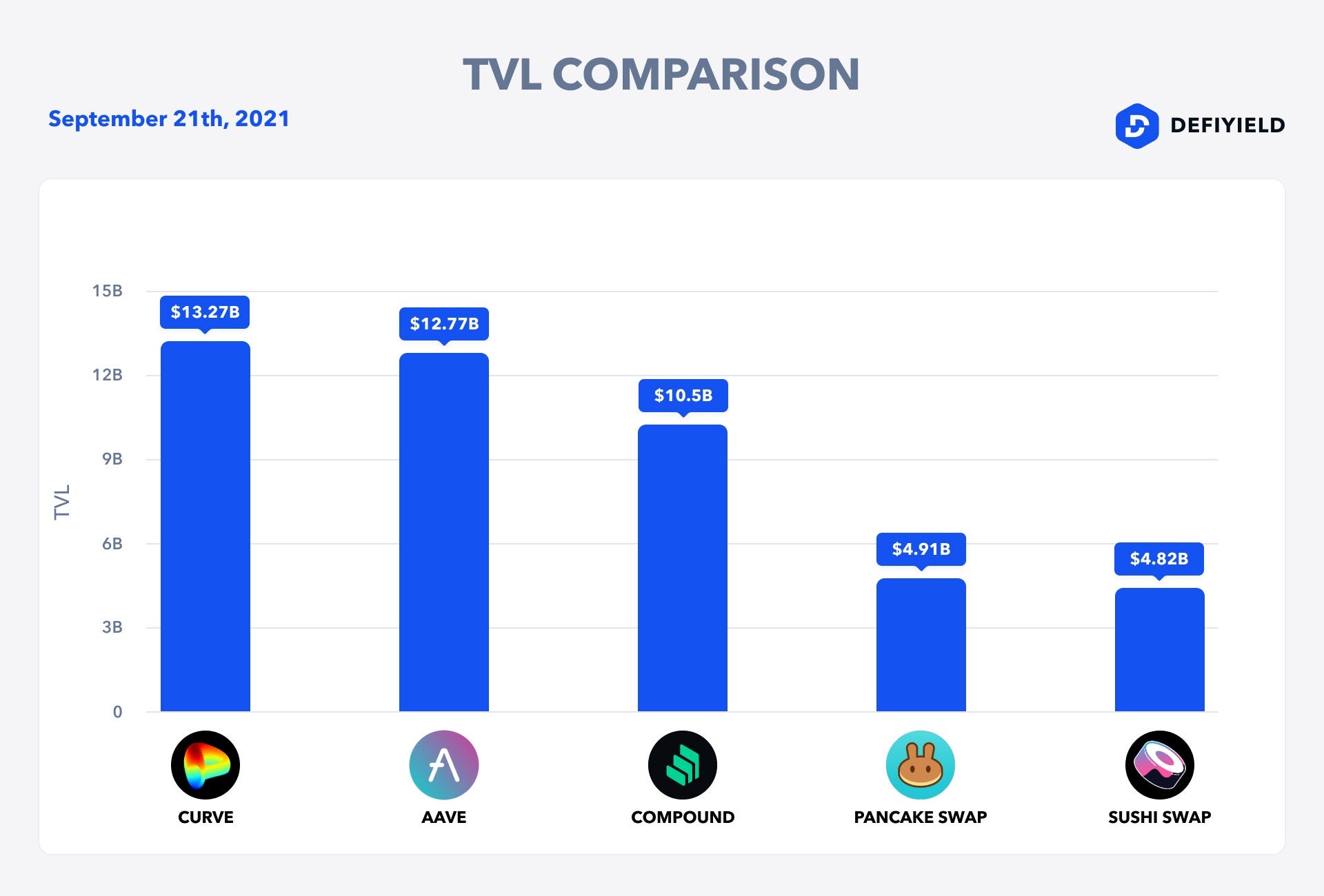

At the moment of writing, Ethereum TVL reached $117B. The projects with the largest TVL on ETH Mainnet are Curve, InstadApp, and Aave.

Ethereum Total Value Locked it the largest out of all the chains — in comparison, there’s a large dominance of ETH.

Check the best pools for Yield Farming ➝

Binance TVL is the second largest TVL after Ethereum Network.

Projects with the biggest TVL on Binance are PancakeSwap, Venus, and Tranchess.

PancakeSwap liquidity pools are integrated on our platform — you can stake and provide liquidity on PancakeSwap by using De.Fi.

Check the Yield Farming guide on Binance ➝

Solana is the third project by the Total Value Locked. It appeared recently and at the time of writing its TVL is $8.8B.

Check out our Yield Farming guide on Solana ➝

The project with the largest number of chains integrated is SushiSwap.

All of the chains above are integrated on our DeFi crypto wallet tracker.

Per the definition from Coinmarketcap: “In order to get the current market cap, you need to multiply the circulating supply by the current price” while TVL is calculated by multiplying the amount of funds that are locked as collateral in the ecosystem by the current price of the assets.

To put in simply:

Market cap = Circulating supply x price of the token (specifically native tokens)

TVL = Funds staked or deposited x price of the assets (not necessarily the native tokens)

Honestly, it’s a term we just coined. But it represents a very important concept that can be confusing for people new to DeFi. This is the concept of wrapped or synthetic/ derivative tokens. For example if I want to use $500 of my Bitcoin on the Ethereum network as collateral.

In the entire cryptocurrency market ecosystem it will really count as $1,000. $500 worth of Bitcoin on the Bitcoin blockchain and $500 of Wrapped Bitcoin on the Ethereum ecosystem. The same can happen when you exchange stable coins like USDC into Compound (or other lending platforms) for cUSDC (Compound’s derivative stablecoin redeemable 1:1 for USDC.)

The intricacies of synthetics and derivatives is outside the scope of this article but we just wanted you to know that sometimes tokens get counted twice. But that’s ok. If you understand that sometimes TVL counts tokens twice, you’re good! When we calculate TVL we include them both. It’s not perfect but it’s the best we’ve got so far!

Enjoyed this? Jump in the conversation for more up to date information!

Join us on Twitter and Telegram!

Want to learn more?

Preparing for the Next Crypto Bull Run

Upcoming Crypto Airdrops for 2023

Smart Contract Audit Services

Crypto Hack & Scam Database

Free Smart Contract Audit

Revoke Crypto Wallet Permissions Tool

As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task.

As the crypto bull market heats up, more investors seek to navigate the burgeoning world of decentralized finance (DeFi).

When engaging with decentralized finance (DeFi), investors often face the challenge of managing investments, tracking yields, and ensuring they keep all their assets safe.

January 2024 was an incredibly important month for us. We achieved significant results and made remarkable progress.

With new crypto ecosystems popping up on a regular basis, the integration of different blockchain networks with popular wallets is a key narrative moving into the next crypto cycle.

This month, we are proud to announce that De.Fi has secured investments from the first BTC ETF provider. We're seeing a huge spike in mentions and social interest in De.Fi and $DEFI token right before the listing.

© De.Fi. All rights reserved.